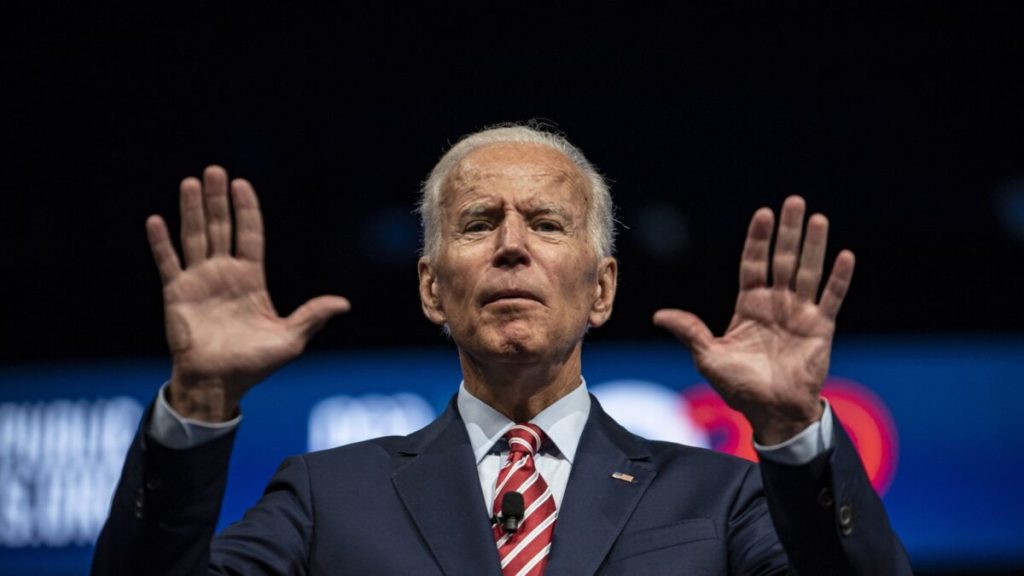

President Joe Biden on Wednesday announced his controversial plan to provide $10,000 in debt cancellation for millions of college-educated Americans — and up to $10,000 more for those with the greatest financial need.

Student-loan borrowers who earn less than $125,000 a year, or families earning less than $250,000, would be eligible for the $10,000 loan forgiveness, Biden announced in a tweet. For recipients of Pell Grants, which are reserved for undergraduates with the most significant financial need, the federal government would cancel up to an additional $10,000 in federal loan debt.

In keeping with my campaign promise, my Administration is announcing a plan to give working and middle class families breathing room as they prepare to resume federal student loan payments in January 2023.

— President Biden (@POTUS) August 24, 2022

I'll have more details this afternoon. pic.twitter.com/kuZNqoMe4I

The move is viewed primarily as a nod towards progressives and younger, college-educated voters who constitute the base of the Democratic Party. But many challenges await the implementation of the President’s plan, from both sides of the aisle.

Does the President have the authority to cancel debt?

Republicans will almost certainly file legal challenges to the plan, on the grounds that the President lacks authority under the Constitution to forgive debt that was sanctioned by Congress. This line of argument insists that only Congress, as the “keeper of the purse strings,” has the authority to do so.

Interestingly, the President’s own Department of Education looked at the issue late last year and arrived at the same conclusion.

The DOE found that it “does not have statutory authority to provide blanket or mass cancellation, compromise, discharge, or forgiveness of student loan principal balances, and/or to materially modify the repayment amounts or terms thereof.”

Speaker of the House Democrat Nancy Pelosi also confirmed last summer that “the president can’t do it — so that’s not even a discussion.”

“Not everybody realizes that,” she said, “but the president can only postpone, delay but not forgive.”

Politically, a mixed bag

The President’s announcement today, while targeted to galvanize his base, has the potential to spark anger on both sides of the political spectrum, with progressives arguing that only full debt forgiveness will be satisfactory.

“If the rumors are true, we’ve got a problem,” Derrick Johnson, the president of the NAACP, which has aggressively lobbied Biden to take bolder action, said Tuesday.

“President Biden’s decision on student debt cannot become the latest example of a policy that has left Black people — especially Black women — behind,” he said. “This is not how you treat Black voters who turned out in record numbers and provided 90% of their vote to once again save democracy in 2020.”

“between 69 and 73 percent of the debt forgiven accrues to households in the top 60 percent of the income distribution”

Penn Wharton Study

Republicans, on the other hand, are decrying the fact that, according to the most recent independent study, “between 69 and 73 percent of the debt forgiven accrues to households in the top 60 percent of the income distribution,” suggesting that the plan is basically a giveaway to the already privileged. Again, even Speaker Pelosi seems to agree.

During an interview with Politico last summer, Pelosi said “Suppose … your child just decided they, at this time, [do] not want to go to college, but you’re paying taxes to forgive somebody else’s obligations,” Pelosi said during a news conference. “You may not be happy about that.”

Inflation and the federal debt

The Penn Wharton Study pegs the cost of the President’s plan at $300,000,000,000. “This cost increases to $330 billion if the program is continued over the standard 10-year budget window.”

Perhaps of more immediate concern is the impact the plan will have on inflation, already at 40-year highs. After authorizing trillions of dollars in new spending in the last eighteen months, adding another $300 billion infusion of cash into the economy is almost certain to exacerbate inflationary pressures.

Repayment deferral extended to December 31, 2022

The President also announced that deferral of debt payments on student loans will be extended to the end of the year. The President indicated that this will be the last deferral. Deferrals began during the height of the COVID pandemic as the government sought to ease the pain of economic shutdowns mandated by the federal government and some state governments.

The President is expected to officially announce his decision at a televised press conference later today.